Trending

Bitcoin Rises 10% Amid Saylor’s Cryptocurrency Support

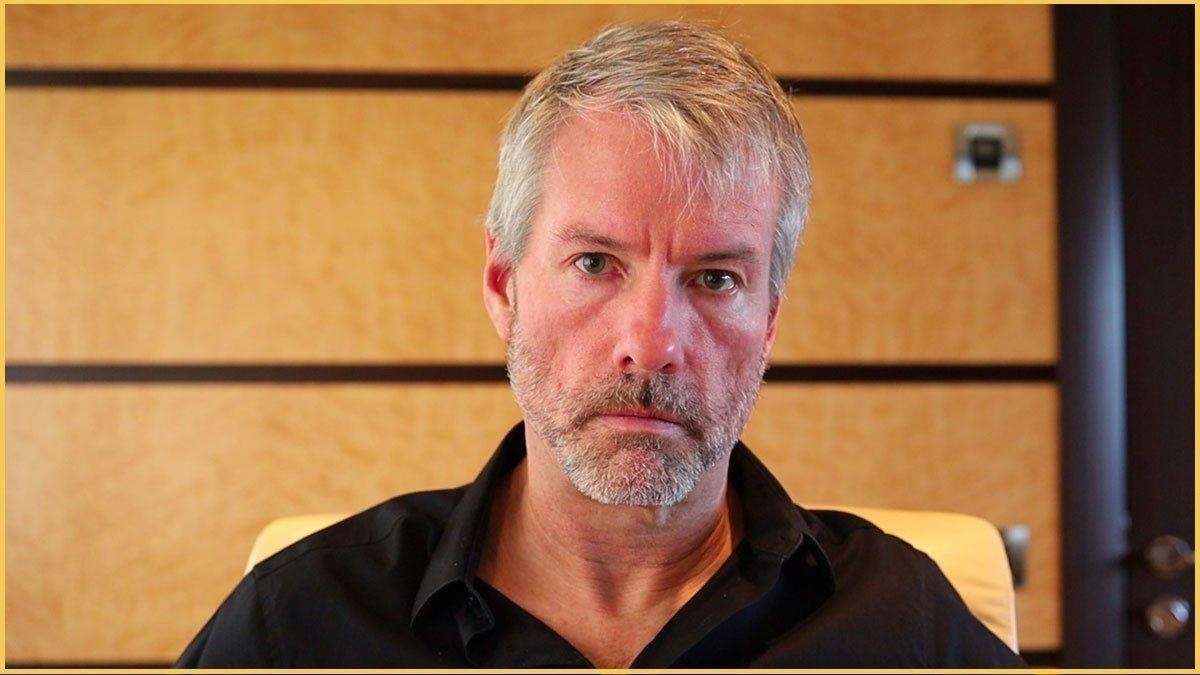

Bitcoin Surges 10% Following Renewed Support from Michael Saylor

Bitcoin experienced a significant surge this week, rising by 10% to reach a record high of $123,091. This rally was largely driven by renewed advocacy from Michael Saylor, Executive Chairman of Strategy, formerly known as MicroStrategy. A prominent figure in the cryptocurrency space, Saylor challenged skeptics with the remark, “short Bitcoin if you hate money,” a statement that has further galvanized bullish sentiment across the market.

Saylor’s unwavering endorsement of Bitcoin as a strategic asset has played a pivotal role in influencing institutional perspectives. Under his leadership, Strategy recently acquired an additional 4,225 BTC, bringing its total holdings to 601,550 BTC, valued at approximately $73 billion. This latest acquisition, made just prior to the price rally, contributed to a 20.2% year-to-date return for the company and propelled its stock price upward by 3%, signaling strong investor confidence in its aggressive Bitcoin strategy.

Institutional Momentum and Market Dynamics

The impact of Saylor’s support extends beyond his own firm, inspiring other high-profile investors such as Robert Kiyosaki, who has publicly announced plans to continue purchasing Bitcoin amid ongoing economic uncertainty. This trend highlights the increasing influence of institutional and prominent individual investors within the cryptocurrency market.

Bitcoin’s price appreciation has also prompted a notable shift in liquidity, with capital flowing away from altcoins like Ethereum and into Bitcoin. On-chain data indicates tightening liquidity and heightened volatility as investors respond to both market momentum and strategic corporate acquisitions. This environment recalls the market dynamics following Tesla’s 2021 Bitcoin purchase, reinforcing Bitcoin’s position as a leading digital asset.

Despite the positive momentum, the rally faces potential headwinds. Regulatory scrutiny is intensifying alongside Bitcoin’s price gains, while broader macroeconomic factors contribute to ongoing market volatility. Additionally, competition from other cryptocurrencies and advancements in mining technology may influence the market landscape, as rival firms consider expanding their Bitcoin holdings to maintain competitiveness.

Looking ahead, the upcoming Crypto Week is anticipated to sustain market enthusiasm. The U.S. House Committee on Financial Services is scheduled to review three significant cryptocurrency bills: the CLARITY Act, the GENIUS Act, and the Anti-CBDC Surveillance State Act. A favorable legislative outcome could provide much-needed regulatory clarity and encourage further institutional investment.

Saylor remains optimistic about Bitcoin’s future, forecasting a potential price of $13 million. While ambitious, this prediction reflects growing confidence in Bitcoin’s role as a store of value and a hedge against inflation. His outlook has resonated with investors, contributing to the positive sentiment underpinning the recent price surge.

As institutional interest grows and regulatory developments unfold, Bitcoin’s latest rally underscores both the opportunities and challenges confronting the cryptocurrency market. Saylor’s influence, combined with strategic corporate actions and evolving regulatory frameworks, continues to shape the trajectory of digital assets.