Trending

Solana’s $500 Million Pump.fun ICO Sells Out Amid Bitcoin’s New All-Time High

Solana’s $500 Million Pump.fun ICO Sells Out Amid Bitcoin’s New All-Time High

The cryptocurrency market experienced a remarkable week as Bitcoin surged to an unprecedented peak above $123,000 before retreating slightly to $117,000. This rally was driven by renewed optimism, bolstered by signals from U.S. lawmakers indicating support for crypto-friendly legislation. Altcoins followed Bitcoin’s lead, with tokens within the Solana ecosystem spearheading the resurgence reminiscent of the “altcoin summer.” Notably, Pudgy Penguins (PENGU) doubled in value, while the combined market capitalization of Solana-based tokens rose by 13%, surpassing the $200 billion threshold. Trading volumes also doubled, reflecting heightened investor engagement.

Solana’s Momentum and Institutional Backing

Institutional interest in Solana remains strong, underscoring confidence in the network’s potential. Treasury firm Upexi successfully raised $200 million across two funding rounds aimed at expanding its holdings of SOL tokens. Meanwhile, NYSE-listed BIT Mining announced plans to raise up to $300 million to facilitate phased acquisitions of Solana assets. These developments highlight a growing corporate race to accumulate SOL, which responded with a steady price increase, reaching a weekly high of $167 before settling at $161—a 7% gain compared to the previous week.

Pump.fun ICO Sells Out in Minutes

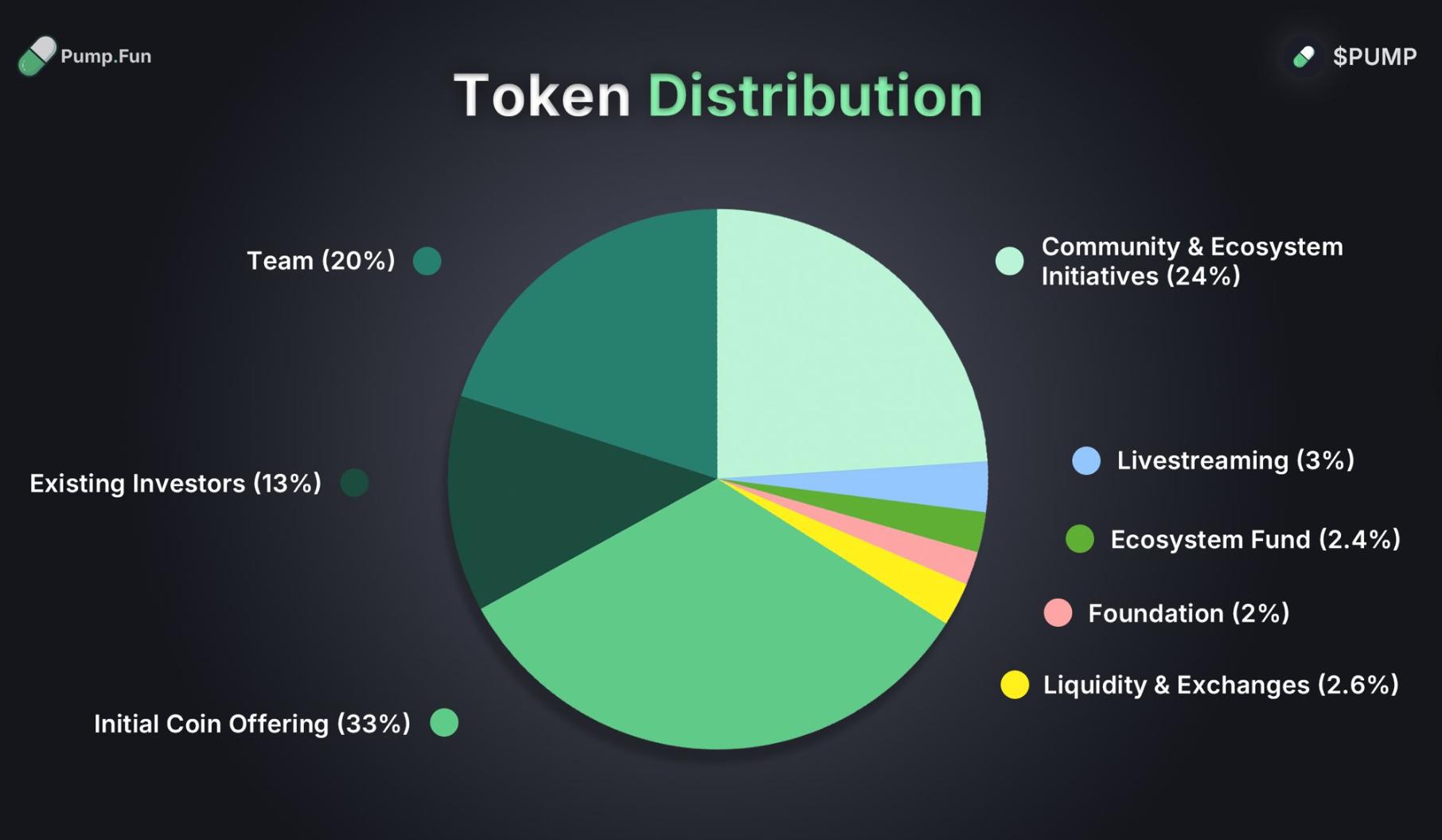

Solana’s premier launchpad, Pump.fun, captured significant attention as its initial coin offering (ICO) sold out within a mere 12 minutes, raising $500 million. Approximately 75% of PUMP token purchases were conducted on the Solana network, underscoring the platform’s efficiency and widespread appeal. However, the rapid sell-out has attracted regulatory scrutiny, raising concerns about oversight and compliance as the scale and speed of such offerings continue to accelerate.

Ecosystem Dynamics and Emerging Competition

Despite these achievements, Solana’s total value locked (TVL) declined from $10.2 billion to $9.2 billion over the week, reducing its market share to 7% and threatening its position as the second-largest Layer 1 blockchain. Decentralized exchange (DEX) volume on Solana reflected broader market enthusiasm, increasing by 40% to $3.3 billion.

The competitive landscape within Solana’s ecosystem is evolving rapidly. Rival launchpad LetsBonk.fun has overtaken Pump.fun in both weekly revenue and the number of tokens launched, intensifying competition. This shift is prompting investors to reconsider their portfolio allocations, potentially increasing volatility within the ecosystem. Additionally, emerging memecoin platforms are gaining momentum, posing a challenge to Pump.fun’s market dominance and diverting investor attention.

Market Winners, Losers, and Volatility

Among the top performers, Pudgy Penguins led the gains, while projects such as WhiteRock and Keep Network continued to experience losses. The rapid pace of innovation and intensifying competition within the Solana ecosystem are contributing to heightened market volatility, as capital flows respond dynamically to new opportunities and emerging platforms.

Strategic Developments and Outlook

In a strategic move to broaden its influence, Pump.fun recently acquired Kolscan, a tool designed to map wallets associated with key opinion leaders (KOLs). This acquisition signals ambitions to develop a large-scale, crypto-native social platform. As Solana’s ecosystem continues to evolve, the interplay between regulatory scrutiny, fierce competition, and shifting investor sentiment will be critical factors shaping its trajectory in the coming weeks.