Trending

Tokenized Stocks Connect Blockchain and Traditional Finance

Tokenized Stocks Connect Blockchain and Traditional Finance

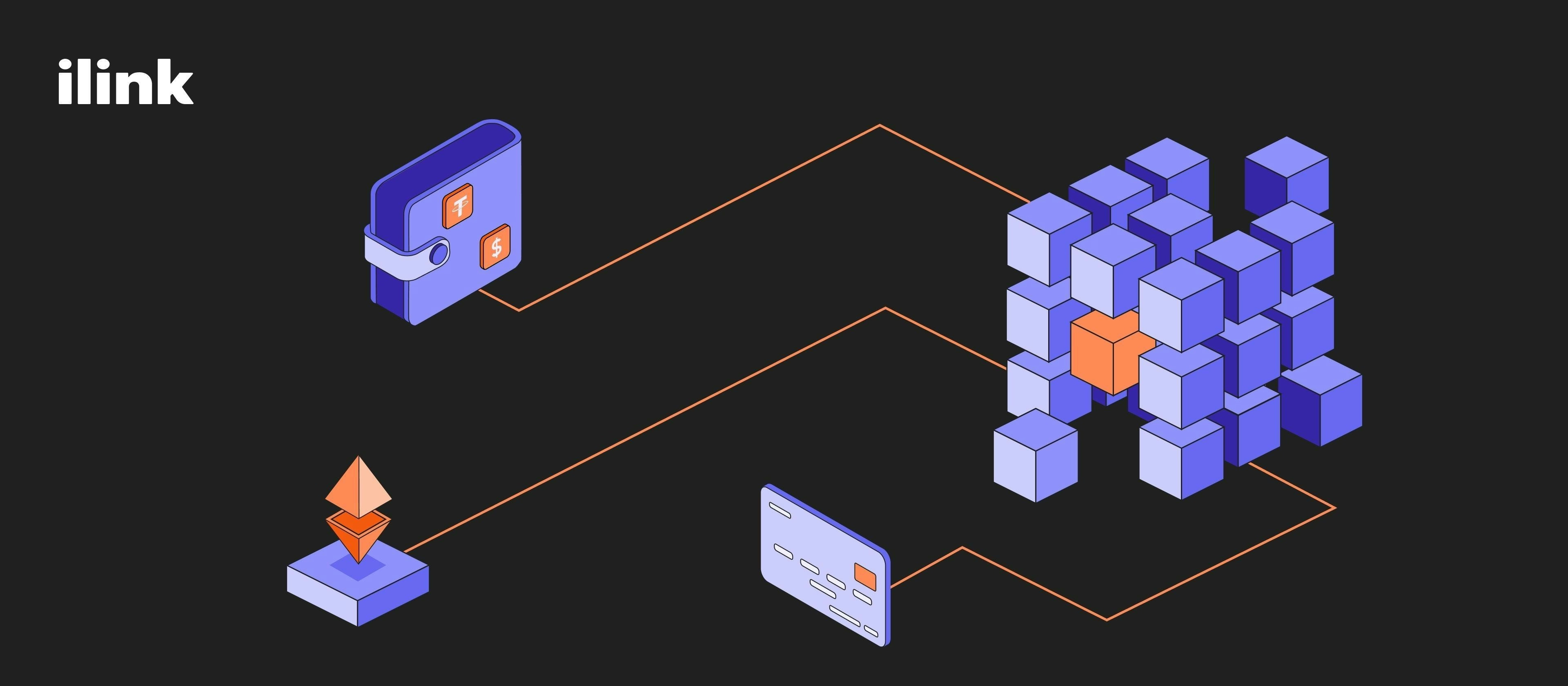

Tokenization is transforming asset ownership by converting real-world assets, such as stocks, into digital tokens recorded on blockchain networks. This innovation facilitates fractional ownership, allowing a wider range of investors to access high-value assets that were previously out of reach. By harnessing blockchain’s security, transparency, and operational efficiency, tokenized stocks introduce continuous, 24/7 trading—an attribute traditionally associated with cryptocurrencies—into conventional financial markets.

Financial Innovation and Market Implications

Tokenized stocks mark a significant advancement in bridging traditional finance (TradFi) with the digital asset ecosystem. Investors can now diversify portfolios by gaining exposure to both established industries and emerging blockchain-related companies within a unified framework. Recent tokenized offerings have included blue-chip corporations such as Tesla, Nvidia, Apple, Amazon, Meta, and Microsoft, alongside firms closely linked to the cryptocurrency sector, including Coinbase, MARA Holdings, and Circle Internet Group. This convergence underscores the increasing integration of legacy industries with blockchain-driven financial innovation.

The benefits of tokenized stocks are multifaceted. Fractional ownership lowers the barriers to entry, enabling investors to purchase portions of shares and thereby diversify their holdings more effectively. The ability to trade these assets around the clock provides unprecedented flexibility, allowing market participants to respond instantly to global developments. Furthermore, blockchain’s immutable ledger enhances transparency and security by recording every transaction, which helps reduce fraud and build investor confidence. Access to a broad spectrum of sectors—from technology to finance and blockchain—also aids in mitigating sector-specific risks.

Despite their potential, tokenized stocks face notable challenges. Regulatory scrutiny remains a primary concern as authorities work to define how these digital assets fit within existing legal frameworks. Market volatility and technological integration issues present additional risks, with price fluctuations potentially intensified by heightened investor interest and speculative activity. In response to these dynamics, traditional financial institutions are beginning to adapt, either by modifying their services or launching blockchain-based products to maintain competitiveness.

Recent industry developments illustrate this trend. For instance, Robinhood has announced plans to incorporate blockchain technology into its platform, signaling a broader effort to innovate within the financial system. Such initiatives are expected to stimulate further advancements as competitors seek to capitalize on emerging market opportunities.

Toward a More Inclusive Financial Ecosystem

The fusion of blockchain technology with traditional finance is reshaping investor engagement with markets. Tokenized stocks exemplify this transformation by combining blockchain’s efficiency and transparency with the stability of established financial instruments. By enabling fractional ownership and continuous trading, tokenization is fostering greater financial inclusivity and democratizing access to global investment opportunities.

Nonetheless, as with any nascent technology, investors must exercise due diligence and remain attentive to evolving regulatory environments. While tokenized stocks hold the potential to redefine investing’s future, navigating their associated risks and rewards will be crucial as the market matures.