Trending

XRP Ledger Rises as SWIFT Transaction Volume Drops 15%

XRP Ledger Gains Momentum Amid Decline in SWIFT Transaction Volume

Global financial institutions are increasingly embracing blockchain-based settlement systems, responding to a notable 15% decrease in transaction volume processed through the SWIFT network. The XRP Ledger (XRPL) has emerged as a compelling alternative, distinguished by its ability to facilitate cross-border payments with significantly greater speed and lower costs. Unlike SWIFT’s traditional infrastructure, which can require several days and multiple intermediaries to complete transactions, the XRPL settles payments within three to five seconds, often incurring fees below one cent.

RippleNet’s Expanding Role in Institutional Transfers

RippleNet, the global payment network powered by the XRPL, is now handling billions of dollars in institutional transfers. At the 2025 Apex XRPL Summit held in Singapore, Ripple projected that the XRPL could capture as much as 14% of SWIFT’s total transaction volume within the next five years. Should current trends persist, this shift could translate into over $21 trillion in transferred value, underscoring the growing influence of blockchain technology in global finance.

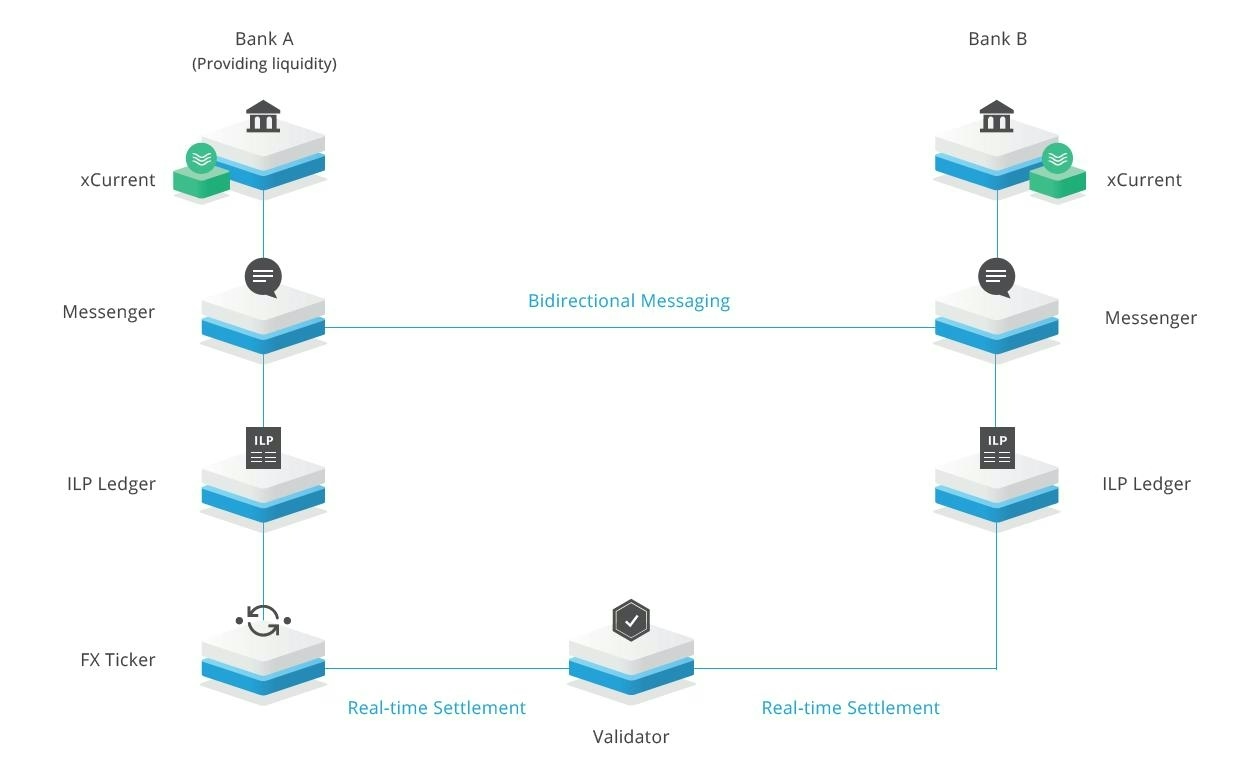

The migration away from SWIFT reflects a broader industry preference for real-time settlement, reduced operational costs, and enhanced transparency. Financial institutions leveraging the XRPL benefit from end-to-end payment visibility, a diminished need for pre-funded accounts, and seamless interoperability. By enabling direct blockchain connectivity, RippleNet eliminates reliance on legacy intermediaries, further accelerating transfer times and reducing associated costs.

Impact on Cryptocurrency Investment and Market Risks

The rapid adoption of the XRPL is also reshaping the cryptocurrency investment landscape. Platforms such as XRP Mining have introduced new contracts designed to generate passive income for holders, marking a strategic shift toward more stable yield generation. For instance, GoldenMining offers mining contracts that provide investors with profit models insulated from secondary market volatility, thereby delivering more consistent cash flow and growth potential. Meanwhile, competitors like JA Mining and FINDMINING are expanding global access to cloud mining, presenting structured alternatives to navigate market fluctuations.

However, this swift expansion carries inherent risks. More than 70% of XRP’s realized market capitalization has been established since late 2024, raising concerns about a potential price correction of up to 35% should market sentiment deteriorate. This concentration highlights the volatility that continues to characterize the sector, even as blockchain-based settlement solutions gain broader acceptance.

Despite these challenges, the momentum behind the XRPL and RippleNet is steadily disrupting traditional cross-border payment systems. Industry experts anticipate further growth in utility and adoption as financial institutions increasingly seek scalable, efficient, and transparent solutions for global transfers. As blockchain platforms like the XRPL continue to gain traction, the global payments landscape is undergoing a profound transformation, with legacy systems such as SWIFT facing mounting competition from faster, more agile alternatives.